Market & Legal Update

October 2022

Market Update | Investors Shake Off Recession Fears as Markets Rally in October

October has historically been known for significant market crashes like the one in 1929, 1987 and 2008, but even given all the volatility in the markets this year, surprisingly this October didn’t prove to be as scary. After a brutal September slump, markets received a boost in October after a positive first estimate of third quarter GDP growth, and an increase in consumer spending and personal income growth, showing that the U.S. Consumer remains resilient in the face of inflation. The Dow registered 4 consecutive weeks of gains and closed out its best month since 1976. The index is now down less than 10% year to date however the S&P 500 and NASDAQ remain in bear market year to date. The S&P 500 was up 8.1% in October and is down 17% year to date while the tech-heavy NASDAQ finished up 3.9% for the month. International equities also posted gains during the month, as the MSCI EAFE Index finished at 5.4% but the index remains negative year to date.

| Market Return Indexes | October 2022 | YTD 2022 |

|---|---|---|

| Dow Jones Industrial Average | 14.1% | -8.4% |

| S&P 500 | 8.1% | -17.7% |

| NASDAQ (price change) | 3.9% | -29.8% |

| MSCI Eur. Australasia Far East (EAFE) | 5.4% | -22.8% |

| MSCI Emerging Markets | -3.1% | -29.2% |

| Bloomberg High Yield | 2.6% | -12.5% |

| Bloomberg U.S. Aggregate Bond | -1.3% | -15.7% |

| Yield Data | October 2022 | September 2022 |

| U.S. 10-Year Treasury Yield | 4.10% | 3.83% |

Despite the positive returns, volatility continued to spike throughout the month across equity, bond and currency markets, as investors worried about the financial market’s ability to cope with the Fed’s persistent tightening cycle. Inflation continues to remain the predominant concern as the Consumer Price Index (CPI) for September came in at an annual rate of 8.2%. Although this was a slight moderation from 8.3% in August, a drop in energy prices drove much of the decline while the “stickier” components like shelter continued to increase. In fact, stripping out the volatile components of food and energy, the Core Index rose 6.6% in October, exceeding economists' expectations and marking the fastest pace since 1982. By both measures, inflation remains stubbornly high and well above the central bank’s target of 2%.

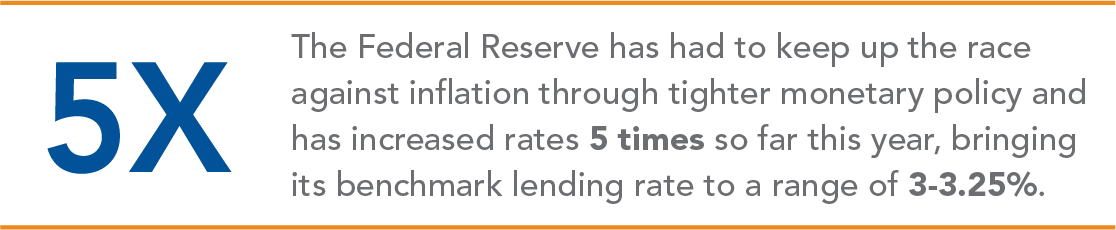

The Federal Reserve has had to keep up the race against inflation through tighter monetary policy and has increased rates 5 times so far this year, bringing its benchmark lending rate to a range of 3-3.25%. It is highly anticipated that the Fed will increase rates by another 75 basis points at the upcoming FOMC meeting on November 2nd, and the most recent projections point to a federal funds rate range of 4.24%-4.50% by the end of 2022. Generally, interest rate increases take time to work their way through the economy and the concern is that the Fed’s aggressive stance may tip an already weakening economy into a recession. After contracting for the first 6 months of the year, the US economy expanded 2.6% during the third quarter and while this is a good sign and indicates that we were not likely in recession the first 6 months of the year, it does not give us enough comfort about avoiding one in the future. A look under the hood reveals that most of the rebound in GDP growth came from a narrowing trade deficit as exports outpaced imports. Net trade benefits tend to be temporary in nature, and a strong dollar and weak global growth will continue to put pressure on future exports. Several economic indicators point to a broad slowing in the U.S. economy, particularly the housing market. Due to the Fed’s aggressive rate hikes, the average mortgage rate has increased sharply in recent months and topped 7% in October, the highest level in more than 2 decades. Higher borrowing costs coupled with steep home prices have led to a decline in affordability conditions. Additionally, existing home sales have contracted every month so far this year.

Market performance was mixed abroad, as the European Central Bank (ECB) decided to raise rates by another 75 basis points for the second time and Eurozone GDP growth came in at a meager 0.2% in the third quarter. Volatility has been exacerbated by the persistent energy crisis in the region due to Russia’s war in Ukraine which continues to push consumer prices higher. Additionally, the U.K.’s newly elected Prime Minister, Liz Truss, tried to push through a fiscal plan with unfunded tax cuts which rocked financial markets. The British pound plummeted to its lowest level against the dollar and U.K. government bond yields surged. The market’s reaction pushed Prime Minister Truss to reverse her fiscal plans and resign after only 44 days in office, which led members of the Parliament to elect former UK finance minister Rishi Sunak as the new prime minister. We expect market volatility to continue abroad as new leadership in the U.K. attempts to stabilize its faltering economy.

Inflationary pressures and recessionary fears will likely remain top of mind for equity and fixed income investors alike. With inflation still stubbornly high and the unemployment rate relatively low, the Fed will likely continue raising rates into 2023, however market pressures may force the Fed to slow down its pace. Disappointing earnings results from several large technology companies at the end of October are a divergence to the earnings resilience theme that has played out so far this year and reflect the challenging macro environment. Finally, uncertainty about the outcome of the mid-term elections in November presents yet another challenge that markets will have to face.

Legal Update | IRS Extends Amendment Deadline to 2025 to Adopt CARES Act Amendments and Provides Hurricane Ian Relief

The Internal Revenue Service (IRS) recently issued Notice 2022-45, which extends the deadline for plan sponsors to amend the following retirement plans for certain optional provisions of the (Coronavirus Aid, Relief and Economic Security (CARES) Act until December 31, 2025. The types of retirement plans include: tax-qualified plans, certain collectively bargained plans, and 403(b) plans that do not cover public school employees.

The deadline before the extension for CARES Act amendments was the last day of the plan year beginning on or after January 1, 2022. The deadline for calendar year plans was December 31, 2022.

The extended CARES Act amendment deadline for governmental retirement plans, including 457(b) governmental plans and 403(b) plans maintained by public schools, is now 90 days following the close of the third regular legislative session beginning after December 31, 2023 for the legislative body with authority to amend the plan. The previous deadline was the last day of the first plan year beginning on or after January 1, 2024.

Please note that the amendment deadline extension is not applicable to 457(b) plans that are sponsored by tax-exempt organizations.

The CARES Act permitted the adoption of the following optional provisions:

- Special Coronavirus-Related Distributions. The CARES Act permitted distributions from eligible retirement plans in an amount not to exceed $100,000 for the 2020 taxable year. The CARES Act distributions were also not subject to the 10% penalty on distributions to individuals who have not yet reached age 59-1/2, nor were they subject to the mandatory 20% withholding tax.

- Plan Loan Limit. The CARES Act also permitted an increase in the maximum dollar amount available for loans from tax-qualified plans from $50,000 to $100,000 and increased the maximum percentage limit for loans from 50% of the present value of a participant’s benefit to 100% of the present value of a participant’s benefit in the plan between March 27, 2020 and December 31, 2020.

- Temporary Plan Loan Repayment Suspension. Furthermore, the CARES Act permitted the due date for any plan loan with a due date beginning on March 27, 2020 and ending on December 31, 2020 to be extended for one year. For this purpose, the 5-year limit on plan loan repayments was disregarded.

- Waiver of Required Minimum Distributions in 2020. The CARES Act waived the payment of required minimum distributions (RMDs) from IRAs and from defined contribution plans that were due to be distributed in 2020. The waiver of 2020 RMDs did not apply to distributions from defined benefit plans, however.

The August 2022 USICG Market & Legal Update stated that the deadline for an amendment required under the CARES Act with respect to the waiver of 2020 required minimum distributions had already been extended to December 31, 2025 pursuant to IRS Notice 2022-33. Notice 2022-45 extended the deadline to December 31, 2025 for other provisions of the CARES Act which gives to plan sponsors a more comprehensive amendment process.

IRS Provides Hurricane Ian Relief for Florida and the Carolinas

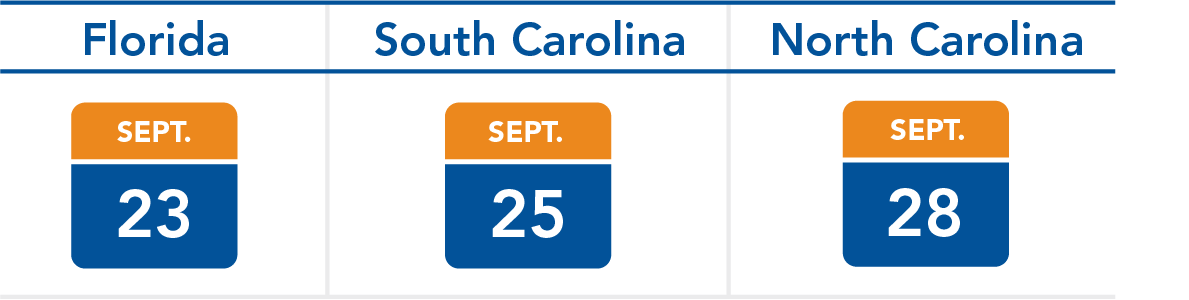

The IRS also recently announced tax relief for victims of Hurricane Ian in Florida, South Carolina and North Carolina. The agency is extending the tax relief to individuals, households and those who have businesses in any area designated by the Federal Emergency Management Agency (FEMA). The tax relief postpones until February 15, 2023 various original and extended tax filing and payment deadlines originally scheduled on or before October 17, 2022 but no earlier than the following dates:

The February 15, 2023 extended deadline applies to quarterly estimated income tax payments due on January 17, 2023 and the quarterly payroll and excise tax returns generally due on October 31, 2022 and January 31, 2023. Calendar-year corporations with original or extended due dates have until the extended due date for any due dates that expire on October 17, 2022. In addition, tax-exempt organizations have until the extended deadline for 2021 calendar-year returns with extensions due to expire on November 15, 2022.

The IRS will also work with any taxpayer who lives outside the affected area, but whose tax records were needed to meet a deadline during the postponement period if the tax records were maintained in an identified disaster area. Affected taxpayers should call the IRS at 866-564-5227.

Individuals and businesses in a FEMA-declared disaster area who suffered uninsured or unreimbursed disaster-related losses can claim these losses on either their income tax return for the 2022 tax year (the year in which the loss occurred) or for the 2021 tax year. On any return claiming a loss, the taxpayer should include the applicable FEMA declaration number: for Florida, the number is DR-4673-FL; for South Carolina, the number is DR-3585-EM-SC; and for North Carolina, the number is DR-3586-EM-NC.

If an affected taxpayer receives an IRS late payment or late filing penalty notice that has an original or extended payment or filing date that falls within the postponement period, the taxpayer should call the number on the notice to request a penalty abatement.

How USI Consulting Group Assists

Your USICG Consultant can help you with any questions you may have regarding the CARES Act and the extended amendment deadlines under Notices 2022-33 and 2022-45, as well as with any other discretionary or required changes to your plan.

While the deadline extension provides some welcome relief, you should work with your USICG consultant to assess your plan’s amendment status and the appropriate deadlines that apply to your plan. Many defined contribution plans that utilize an IRS pre-approved document have recently received and adopted interim amendments, prior to the announcement of the deadline extension, for all or some of the CARES Acts provisions. Most other plans have yet to be amended for these interim amendments and can take advantage of deadline relief. USICG consultants can also assist you with the understanding the tax relief provided to Florida, North Carolina and South Carolina victims of Hurricane Ian.

Retirement Resources for You

USI Consulting Group's team of experts is happy to assist employers with all retirement plan compliance matters and changes in the market, including those discussed here, to help you mitigate risk and financial impact to your organization.

Questions? Contact your USICG representative, visit our Contact Us page or reach out to us directly at information@usicg.com.

Find the address and telephone number of your local USI Consulting Group office here.

For previous market and legal commentaries please click here.

This communication is published for general informational purposes and is not intended as advice or a recommendation specific to your plan. Neither USI nor its affiliates and/or employees/agents offer legal or tax advice.

An index is a measure of value changes in a representative grouping of stocks, bonds, or other securities. Indexes are used primarily for comparative performance measurement and as a gauge of movements in financial markets. You cannot invest directly in an index and, for comparative purposes; they do not reflect the effect of the various fees inherent in actual investment vehicles.

The S&P 500 Index is a market value weighted index showing the change in the aggregate market value of 500 U.S. stocks. It is a commonly used measure of stock market total return performance.

The Dow Jones Industrial Average is a price weighted index comprised of 30 actively traded blue chip stocks; primarily industrial companies, but including some service oriented firms.

The NASDAQ Composite Index is a market-value weighted index that measures all domestic and non-U.S. based securities listed on the NASDAQ Stock Market.

Gross Domestic Product (GDP) is the market value of the goods and services produced by labor and property in the U.S. It is comprised of consumer and government purchases,

net exports of goods and services, and private domestic investments. The Commerce Department releases figures for GDP on a quarterly basis. Inflation adjusted GDP (or real GDP) is used to measure growth of the U.S. economy.

The MSCI Europe and Australasia, Far East Equity Index (EAFE) is a market capitalization weighted unmanaged index developed by Morgan Stanley Capital International to measure approximately 1,100 securities in 21 major overseas stock markets. It is a commonly used measure for foreign stock market performance.

The Barclays Capital U.S. Aggregate Index covers the U.S. Dollar denominated investment grade, fixed-rate, taxable bond market of SEC-registered securities.

The Barclays Capital U.S. Corporate High Yield Index covers the U.S. Dollar denominated, non-investment grade, fixed income, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s Fitch, and S&P is Ba1/BB+/BB+ or below.

The MSCI Emerging Markets Index (EM) is a free-float-adjusted market-capitalization index developed by Morgan Stanley Capital International. It is designed to measure the equity market performance of 26 emerging market countries.

The 10 Year Treasury Yield is the interest rate the U.S. government pays to borrow money for a 10-year period. In addition to influencing how much the government pays to borrow over this time-frame, the 10-year Treasury Yields also determines how much investors earn by investing in this debt and it is a good indicator of investor sentiment The higher the yield, the better the economic outlook.

Market Update is a monthly publication circulated by USI Advisors, Inc. and is designed to highlight various market and economic information. It is not intended to interpret laws or regulations.

This report has been prepared solely for informational purposes, based upon information generally available to the public from sources believed to be reliable, but no representation or warranty is given with respect to its completeness. This report is not designed to be a comprehensive analysis of any topic discussed herein, and should not be relied upon as the only source of information. Additionally, this report is not intended to represent advice or a recommendation of any kind, as it does not consider the specific investment objectives, financial situation and/or particular needs of any individual client.

Investment Advice provided by USI Advisors, Inc. Under certain arrangements, securities offered to the Plan through USI Securities, Inc. Member FINRA/SIPC. 95 Glastonbury Blvd., Suite 102, Glastonbury, CT 06033.

USI Consulting Group is an affiliate of both USI Advisors, Inc. and USI Securities, Inc.

Investment Advice provided by USI Advisors, Inc. Under certain arrangements, securities offered to the Plan through USI Securities, Inc. Member FINRA/SIPC.

USI Consulting Group is an affiliate of both USI Advisors, Inc. and USI Securities, Inc.

5022.S1101.0075

RECENT PUBLICATIONS

- December 2025 | Market & Legal Update 1/5/2026

- November 2025 | Market & Legal Update 12/3/2025

- October 2025 | Market & Legal Update 11/4/2025

Not receiving our newsletter?

Stay up to date with retirement plan updates and insights by subscribing to our email list.