We are halfway through 2024 and economic activity is proving to be more solid than anticipated, leading to cautious optimism. During these times of uncertainty and change, I want to thank you for the trust and confidence you have placed in us. In this edition of our newsletter, updates and key developments at USI Consulting Group (USICG), as well as our parent company, USI Insurance Services (USI) are featured as we continue to expand our horizons to bring our clients sophisticated solutions delivered with exceptional service.

USICG 2024 HIGHLIGHTS

![]() Our national presence continues to expand with new team members located in Arizona, California, Florida, Kentucky, Massachusetts, Nebraska, Ohio and Washington.

Our national presence continues to expand with new team members located in Arizona, California, Florida, Kentucky, Massachusetts, Nebraska, Ohio and Washington.

![]() In January, USI and USI Consulting Group announced the acquisition of Rochester, New York-based Burke Group. Founded in 1989, Burke is a regional advisory services firm specializing in retirement plan consulting, administration and actuarial services.

In January, USI and USI Consulting Group announced the acquisition of Rochester, New York-based Burke Group. Founded in 1989, Burke is a regional advisory services firm specializing in retirement plan consulting, administration and actuarial services.

![]() Brian Robb, USICG National Sales Leader, recently shared his insights on the value of Total Retirement Outsourcing (TRO) with PLANSPONSOR. Check out the article to learn more about how TRO may help you.

Brian Robb, USICG National Sales Leader, recently shared his insights on the value of Total Retirement Outsourcing (TRO) with PLANSPONSOR. Check out the article to learn more about how TRO may help you.

We continue to host informative webinars discussing important legislation, trends and tips for employers:

We continue to host informative webinars discussing important legislation, trends and tips for employers:

- 2024 Retirement Plan Outlook: What You Need to Know focused on the latest SECURE 2.0 updates, 2024 retirement plan compliance requirements and best practices to help organizations optimize their retirement plan(s).

- Employee Financial Well-Being: It Matters to Your Business featured industry experts discussing why it’s important for employers to prioritize the holistic well-being of their workforce and how they can significantly reduce benefit costs by helping employees take control of their finances and save more for their future.

|

|

|

Defined Benefit (DB) Consulting & Actuarial Services

Supporting pension plans, OPEB, cash balance plans, derisking, termination & annuity placements

Funded levels in corporate pension plans have continued to rise in recent years given the surge in interest rates and rebounding equity values. Pension risk transfer (PRT) sales continue to break records, as the first quarter of 2024 has generated $14.2 billion -- 124% higher than the prior year’s result, according to LIMRA. If you’ve been contemplating de-risking your defined benefit pension plan, the time may be right to develop a successful strategy. Our integrated team of experienced actuarial consultants and investment advisors work together to achieve plan objectives while minimizing funded status variability. Learn how your organization can take action now to mitigate risk and avoid costly mistakes.

We are committed to supporting our clients and keeping them updated on current market trends and the impact they may have on your plan. Check out our latest insights:

- We launched our sixth annual Municipal Pension and OPEB Report which reveals in-depth information on Connecticut public sector plans based on data extracted from the Annual Comprehensive Financial Reports (ACFR). Although ACFR data is extensive and sometimes difficult to understand in its raw form, our team of experienced actuaries have extrapolated the main findings, making it easier for employers to use the report to benchmark their own plans. Although the report analyzes Connecticut municipal plan data, inflation continued nationwide in 2023 making the study relevant to employers beyond this border.

- Our recent webinar explored how a Direct Recognition Variable Investment Plan (DR-VIP) can help companies looking for larger tax-deductible contributions and boosted retirement savings for their owners and highly compensated employees. If you weren’t able to attend the webinar, watch the replay and discover all the advantages your company can achieve with this innovative solution.

- If a single employer overfunded pension plan is terminating and its participants and beneficiaries are on track to receive full benefits, you may wonder if you can keep the excess. Check out Terminating an Overfunded Pension Plan? Who Gets the Excess?

DB Administration Services

Custom online plan administration solutions

Our Benefit Administration (BA) practice has had a busy first half of the year. With continual interest in de-risking projects and a steady pipeline of new implementations and recurring administration work, our teams are busy helping clients with pension plan terminations, terminated vested buyouts and data work.

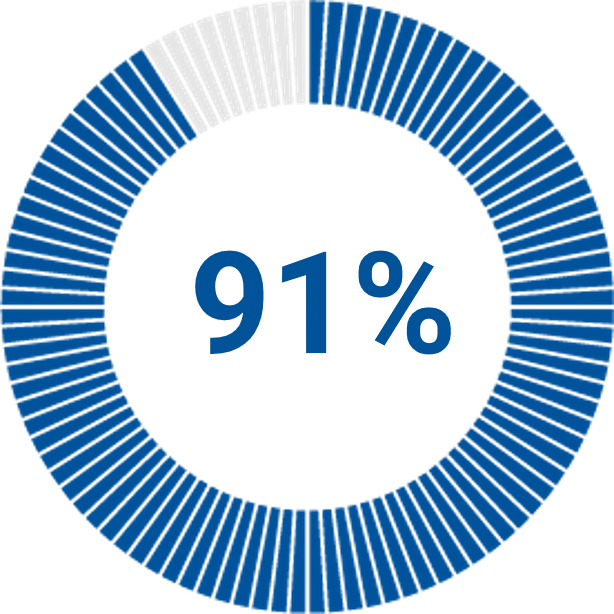

In addition, earlier this year we conducted our first client survey focused solely on the needs of our BA clients. On the heels of the positive results, we are rolling out:

- New dashboard metrics that can be run periodically instead of only annually.

- A fresh look for our Retirement Focus website with additional functionality.

- A new “Small Plan Solution” delivery model, offering smaller- sized clients access to many of our Retirement Focus web tools and call center.

- Two new strategic applications to aid producers and employers in analyzing the benefits of terminated vested buyouts and auto-rollover services.

Defined Contribution (DC) Consulting

Supporting 401(k), 403(b), 457, money purchase & profit-sharing plans

The DC Consulting team has continued to grow by welcoming new team members located in Massachusetts and Nebraska. Key highlights from the first half of the year include:

- Assisting clients in assessing ongoing retirement plan design options. Most of these projects have focused on alternative matching or other employer contributions as our clients prioritize recruiting, retaining and promoting retirement readiness for employees. In addition to calculating the financial impact of alternative employer contributions, our team provides plan benchmarking by industry and peers.

- Assessing client’s retirement plan’s recordkeeper’s protocols and technology to prevent cyber-attacks and help protect participants’ accounts. A cyber review can help employers prepare for their annual plan audit and other inquiries they may receive from the Department of Labor (DOL). We work with recordkeeping partners to help prioritize educating retirement plan participants about cybersecurity best practices, which includes reminding them to register their accounts and establish dual authentication with the recordkeeper to help diminish the risk of fraudulent activity.

- In February, USICG’s SVP & Practice Leader of DC Consulting, Doug LaMendola, spoke with PLANSPONSOR to discuss “How Sponsors Can Get the Most out of DC Plan Design Changes.” Read the full article to learn how employers can add the most value to their plans.

Direct Solutions®

Bundled DC plan services through a single provider

The Direct Solutions team has delivered the following enhancements this year:

- Boosted our USI Mandatory Account Rollover Solution (USI-MARS) program that provides the plan automatic rollover IRA distributions of terminated vested amounts from $1 to $7,000 to assist employers dealing with smaller balances. This program automatically removes those smaller unclaimed accounts from the plan, eliminates problems with uncashed small checks and reduces risk for the organization.

- Expanded our Employee Stock Ownership Plan (ESOP) capabilities regarding the IRS Code 1042 Exchange ESOP transactions allowing owners of corporations to secure the sale of their business on a tax-free basis. In addition, we expanded our capabilities for customized ESOP Repurchase Liability Studies to create a financial “dashboard” that will allow greater financial management and planning for ESOP stock repurchase obligations.

- Enriched employee education services to include group presentations and individual investment education sessions focused on investing in a volatile market and retirement income planning.

- Continue to develop enhancements that will accommodate new SECURE 2.0 Act provisions for retirement plans, including new distribution options and the self-certification rules, Long Term Part Time (LTPT) participation rules, Roth conversions for employer matching accounts, preparing for qualified student loan matching contributions and the new Required Mandatory Distribution limit of $7,000. We presented our recommendations and a checklist to help clients decide which optional provisions they choose to offer.

- Expanded investment offerings for the platform with new fund options available for employers to add to their retirement programs, including funds with new Environment, Social and Governance (ESG) standards and protocols as outlined by the DOL. We also expanded the number of funds available in the Stable Value investment category that provide “buy-out” options for legacy contract market value adjustments with improved interest crediting rates.

- Rolled out our improved website capabilities for plan participants to select and set up their own data aggregator services. This enhancement allows participants to share account data with several of the most popular data aggregator tools to improve their own personal financial well-being.

Emerging Plan DC Solutions (EPS)

Catering to the unique needs of small & midsize plans

Our EPS practice has continued to grow by welcoming new team members located in Arizona, California, Florida, Kentucky, Ohio, and Washington. Our robust model includes administration and compliance collaboration/guidance, along with relationship management and proactive service to support our clients in the emerging market retirement space including:

- Benchmarking to evaluate a retirement plan’s marketplace competitiveness with specific retirement recordkeepers identified as providing a strong offering for the employer’s size. This strategy ultimately helps the employer improve their overall pricing, product, technology, investment and service offering to their employees.

- Plan design consulting as an Administrator. Our compliance consulting team provides guidance on how design decisions impact effectiveness and help to solve compliance issues such as missed deferrals, complex control group situations and missing/late 5500s. Our Fiduciary Checklist, which is reviewed periodically with clients, also helps employers meet their fiduciary obligations.

- Customized plan design and management for start-up plans to $1M in plan assets. This service provides the highest level of fiduciary oversight and a ‘hands on’ approach that is needed for an employer just starting to navigate the retirement landscape.

- Recently, a mandate in a number of states now requires companies of a certain size to start a retirement plan for their employees or face penalties. Our team will work with these companies to offer a comprehensive and cost- effective option. One example is California’s CalSavers Program. Read our summary of the CA Retirement Plan Mandate highlighting the overall impact and details on associated penalties for non-compliance.

- Actively engaging with clients and prospects on SECURE 2.0 provisions and updates to recordkeeping requirements, while providing consulting oversight on how they may impact their plan. We continue to expand our compliance consulting team and are building data automation efficiencies to enable the team to focus on client consulting and training. These new efficiencies enable us to strengthen our personal approach with employers, which is greatly needed as the regulatory environment continues to evolve.

Investment Advisory Services

Provided by our highly qualified USI Advisors team

The Investment Advisory Services team has had a busy beginning to the year being actively engaged in industry events, keeping our pension plan clients informed of impacts due to the current market environment and enhancing our processes. Features include:

- Joined forces with an industry expert from S&P Global Market Intelligence to host an insightful “Fireside Chat: 2023 Market Review, the Pension De-risking Landscape & Opportunity”.

- Expanded investment strategy vehicle offerings available on the USICG platform across multiple asset classes.

- Further enhanced our internal target date fund evaluation tool to help employers with the fiduciary responsibility of selecting a new provider or reviewing an existing provider based on DOL guidelines. The tool assesses glide path design, product structure, track record and risk management and provides an efficient method to identify suitable target date providers, aligning the available options with the client’s specific objectives and plan demographics.

USI 2024 HIGHLIGHTS

- In May, USI was named a winner of Glassdoor’s inaugural award for Best-Led Companies 2024 in the nation, ranking as No. 11 among companies across all industries in the U.S. with 1,000+ employees. USI is the only insurance brokerage and consulting firm among the recognized top 50. This award honors companies with leadership teams that go above and beyond to redefine the employee experience.

- USI was also proud to be recognized by Newsweek as One of America’s Greatest Workplaces for Diversity in 2024. This recognition directly reflects USI’s ongoing commitment to the inclusive culture we are continuously innovating.

- For the second year in a row, USI was among only a select number of insurance organizations recognized by Insurance Business America’s (IBA) “5-Star DE&I Awards” for their work to foster impactful, forward-looking diversity, equity and inclusion (DE&I) programs.

- For the second consecutive year, USI was also honored as one of the nation’s Best and Brightest in Wellness. This annual program identifies and honors organizations with the most innovative wellness, wellbeing, and human resource practices.

View the complete listing of USI’s latest industry awards and recognitions.

Thank you again for your partnership and trust. We not only value our relationship with you, we take the responsibility of being your retirement consultant very seriously and will continue to bring new ideas that help you and your employees achieve your retirement goals. Please contact me directly with any questions, feedback or concerns.

On behalf of the entire USICG team, have a great summer!

p: 860.368.2928 | e: bill.tremko@usi.com

Investment Advice provided to the Plan by USI Advisors, Inc. Under certain arrangements, securities offered to the Plan through USI Securities, Inc. Member FINRA/SIPC. 95 Glastonbury Blvd., Suite 102, Glastonbury, CT 06033. Both USI Advisors, Inc. and USI Securities, Inc. are affiliates of USI Consulting Group. | 1024.S0716.0048

INSIGHTS BY TOPIC

Not receiving our newsletter?

Stay up to date with retirement plan updates and insights by subscribing to our email list.